Introduction

Welcome to the QlicknPay API! You can use our API to access QlicknPay API endpoints for bill presentation and payment collection. Our gateway supports multiple payment options (FPX/Credit Card/E-Wallet) and many e-commerce platforms as well as marketplaces such as Lazada & Shopee.

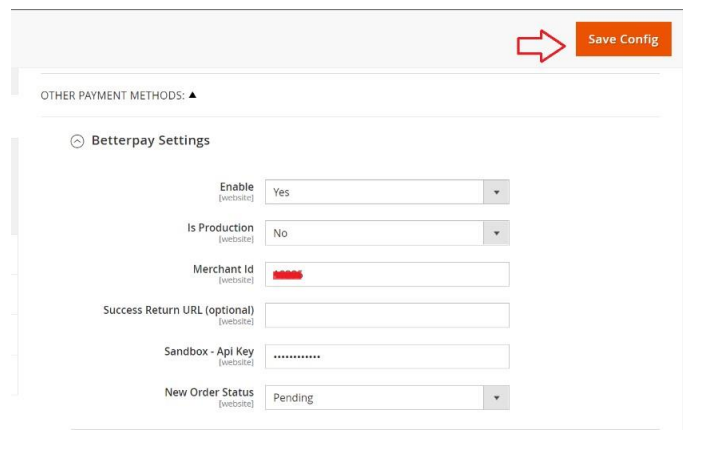

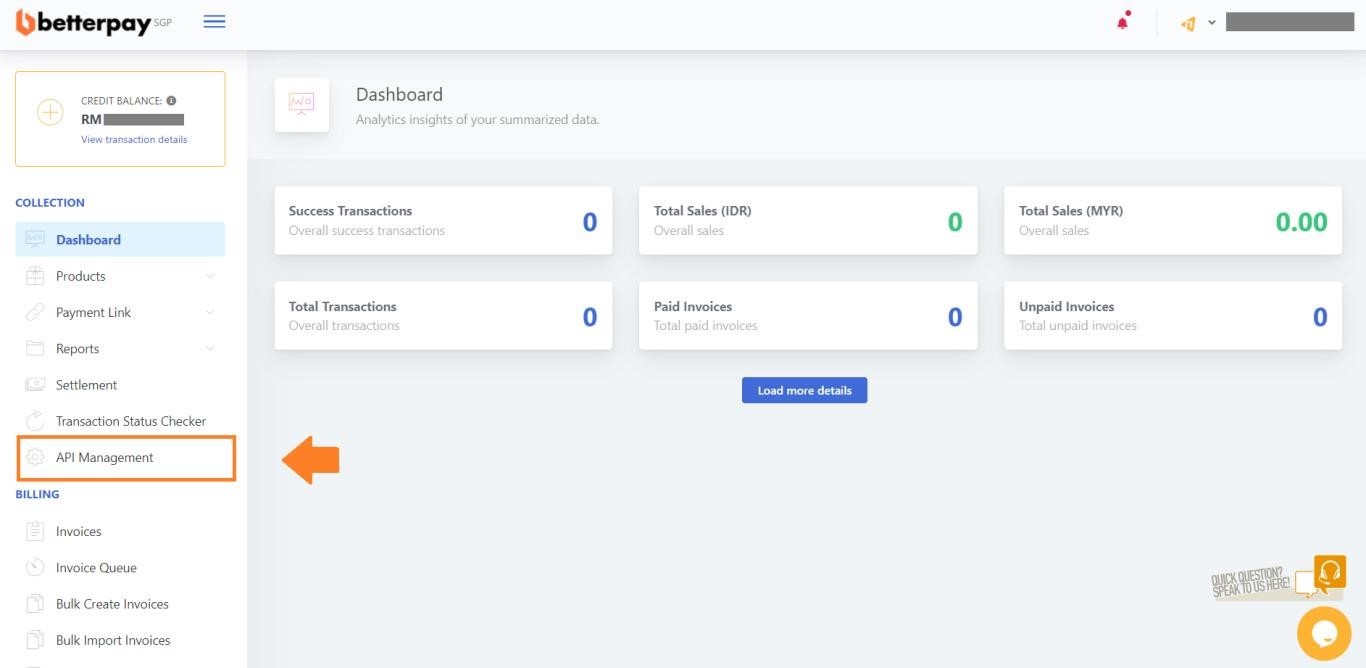

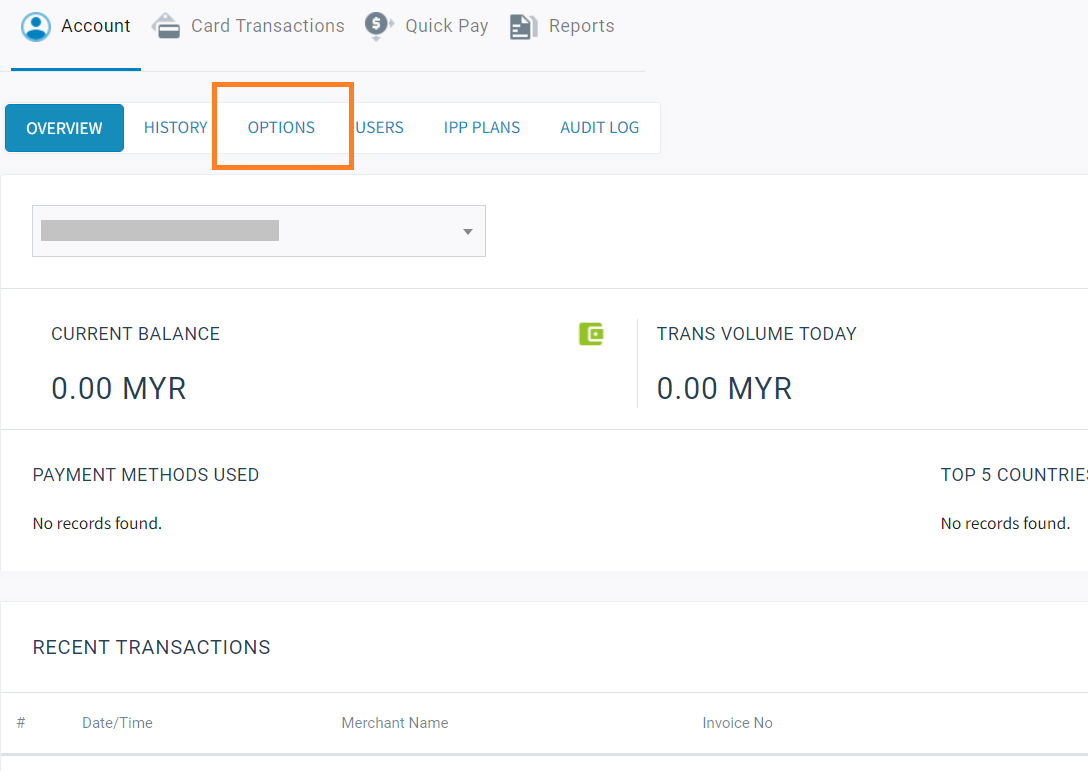

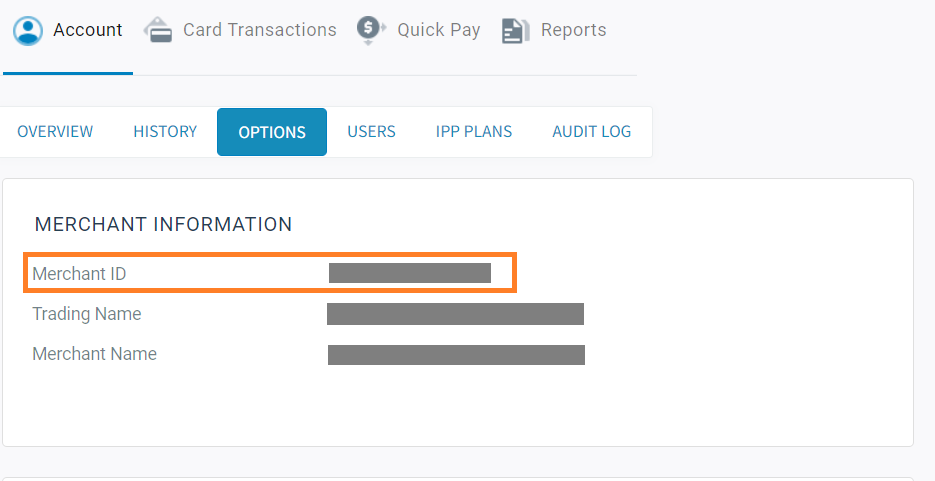

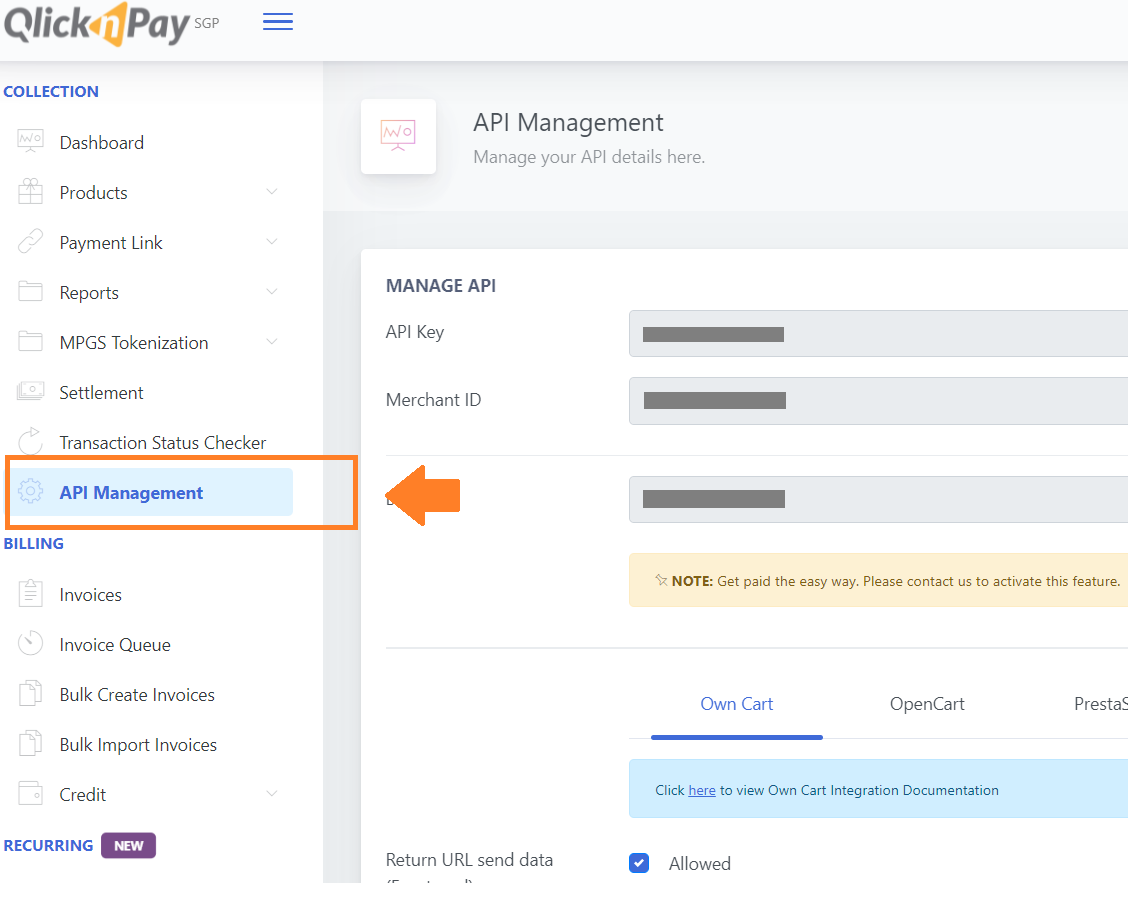

In order to use the API, you will need your Merchant ID and API Key. These credentials can be retrieved in QlicknPay Payment Gateway portal, under Manage API Tab. Please keep this credentials secure. Do not disclose to anyone.

All API requests must be made over HTTPS. Calls made over plain HTTP will fail. All request must be hashed for authentication.

Rate Limit

All API GET method Endpoints are subject to rate limit.

The limit is 100 requests per request window (5 minutes period).

The limit is cumulative either per IP address or account, and is not counted per API Endpoint Basis. Requesting for specific API Endpoint will reduce

the limit for another API Endpoint within a request window.

Exceeding the rate limit will result to 429 Too Many Requests.

RESPONSE PARAMETER

Example response (429):

{

"response": "99",

"msg": "Rate limit exceeded 25/42s[60.49.75.249]. Expire in 28",

}

{

"response": "99",

"msg": "Rate limit exceeded 25/42s[60.49.75.249]. Expire in 28",

}

Response parameter will be as usual if didn't exceed the rate limit. Otherwise, the response parameters will be as follows:

| Parameter | Value |

|---|---|

| response | 99 |

| msg | Rate limit exceeded 25/42s[60.49.75.249]. Expire in 28 |

Standard Payment Gateway

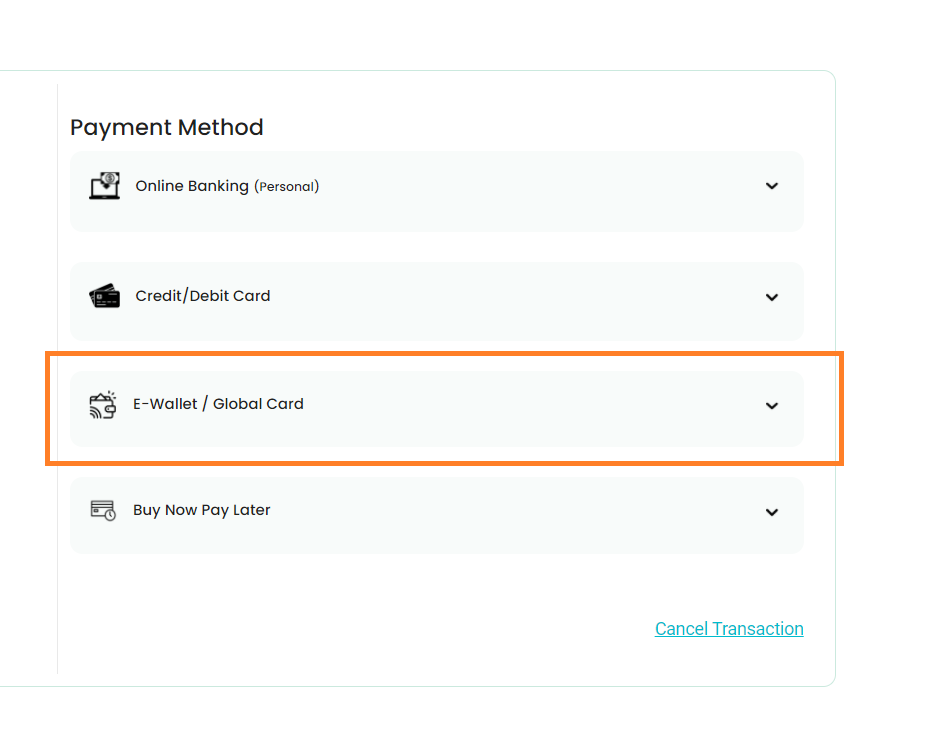

This feature will redirect your payer to QlicknPay checkout page. You payer can then select the different payment options provided.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Requirement to Use the API

Kindly get the following credentials ready in order to start using this API.

- Merchant ID

- API Key

You can retrieve this information at API Management page.

How to send a Payment Request?

Kindly ensure the payment request you send to either of the above mentioned endpoints comply to the following format using POST method. You can set fields with OPTIONAL tag to NULL or exclude it entirely if it is not required.

Required Arguments

Example request:

Please select PHP to view the sample code

<?php

/**

* This is a sample code for manual integration with QlicknPay

* It is so simple that you can do it in a single file

* Make sure that in QlicknPay Dashboard you have key in the return URL referring to this file

*/

# please fill in the required info as below

$merchant_id = '10001'; // this refers to your Merchant ID that can be obtain from QlicknPay

$api = 'APIKEY100001'; // API key

# this part is to process data from the form that user key in, make sure that all of the info is passed so that we can process the payment

if(isset($_POST['amount']) && isset($_POST['invoice']) && isset($_POST['payment_desc']))

{

# assuming all of the data passed is correct and no validation required. Preferably you will need to validate the data passed

$hashed_string = md5($api."|".urldecode($merchant_id)."|".urldecode($_POST['invoice'])."|".urldecode($_POST['amount'])."|".urldecode($_POST['payment_desc']));

# now we send the data to QlicknPay by using post method

$QlicknPay_link_sandbox = '{Sandbox URL}';

$QlicknPay_link_live = '{Live Production URL}';

?>

<html>

<head>

<title>QlicknPay Payment Gateway API Sample Code</title>

</head>

<body onload="document.order.submit()">

#Specified the link below either for sandbox or live production

<form name="order" method="post" action="<?= $QlicknPay_link_sandbox ?>">

<?=# REQUIRED FORM START HERE ?>

<input type="hidden" name="merchant_id" value="<?= $merchant_id; ?>">

<input type="hidden" name="invoice" value="<?= $_POST['invoice']?>">

<input type="hidden" name="amount" value="<?= $_POST['amount']; ?>">

<input type="hidden" name="payment_desc" value="<?= $_POST['payment_desc']; ?>">

<input type="hidden" name="hash" value="<?= $hashed_string; ?>">

<?=# REQUIRED FORM END HERE ?>

<?=# OPTIONAL FORM START HERE ?>

<?=# Set this as null or remove it if you're not required this form. This form will display on payment gateway and save the value in dashboard ?>

<?=# Buyer Name ?>

<input type="hidden" name="buyer_name" value="John">

<?=# Buyer Email. Must be valid email address. Buyer will get transaction status through this email ?>

<input type="hidden" name="buyer_email" value="John@gmail.com">

<?=# Buyer Phone number with country code ?>

<input type="hidden" name="phone" value="+0123456789">

<?=# Buyer Address form line 1?>

<input type="hidden" name="add_line_1" value="10-3, 3rd Floor Jln PJU 5/9">

<?=# Buyer Address form line 2?>

<input type="hidden" name="add_line_2" value="Dataran Sunway Kota Damansara">

<?=# Buyer Postcode ?>

<input type="hidden" name="postcode" value="47810">

<?=# Buyer City ?>

<input type="hidden" name="city" value="Petaling Jaya">

<?=# Buyer State ?>

<input type="hidden" name="state" value="Selangor">

<?=# Buyer Comment ?>

<input type="hidden" name="comment" value="">

<?=# Your callback url for backend process. If you already have specified it on your dashboard but want a different url for different process, please include this form. ?>

<?=# Your Back-end Process ?>

<input type="hidden" name="callback_url_be" value="https://www.example.com/callback_url_be.php">

<?=# Your Front-end Process Success interface ?>

<input type="hidden" name="callback_url_fe_succ" value="https://www.example.com/callback_fe_succ.php">

<?=# Your Front-end Process Fail interface ?>

<input type="hidden" name="callback_url_fe_fail" value="https://www.example.com/callback_url_fe_fail.php">

<?=# If you required a variable that provide the same value when you return it after transaction, use this baggage form. You can have more than one variable.?>

<?=# Please seperate each variable and value by using '|'. Please make sure that every form's value below not more than 5000 characters ?>

<?=# Your vaiable(s)?>

<input type="hidden" name="baggage_variable" value="variable1|variable2|variable3|variable4">

<?=# Your value(s) of each variable(s). Must be synchonize with the total variable above ?>

<input type="hidden" name="variable1" value="value1">

<input type="hidden" name="variable2" value="value2">

<input type="hidden" name="variable3" value="value3">

<input type="hidden" name="variable4" value="value4">

<?=# Custom your payment title and contact. ?>

<input type="hidden" name="header_title" value="Payment Title">

<input type="hidden" name="header_email" value="contact@gmail.com">

<input type="hidden" name="header_phone" value="0123456789">

<?=# OPTIONAL FORM END HERE ?>

</form>

</body>

</html>

<?php

}

else

{

?>

<html>

<head>

<title>QlicknPay Payment Gateway API Sample Code</title>

</head>

<body>

<form method="post" action="<?= htmlentities($_SERVER['PHP_SELF']); ?>">

<table>

<tr>

<td colspan="2">Please fill up the detail below in order to test the payment.</td>

</tr>

<tr>

<?=# AMOUNT VALUE MUST MORE THAN RM1.50 AND WITH 2 DECIMAL POINTS ?>

<td>Amount</td>

<td>: <input type="text" name="amount" value="" placeholder="Amount to pay, for example 12.20" size="30"></td>

</tr>

<tr>

<?=# DESCRIPTION MUST BE LESS THAN 1,000 CHARACTERS ?>

<td>Payment Description (Not more than 1,000 character)</td>

<td>: <input type="text" name="payment_desc" value="" placeholder="Description of the transaction" size="30"></td>

</tr>

<tr>

<?=# MUST BE UNIQUE ?>

<td>Invoice (Not more than 17 char without '-')</td>

<td>: <input type="text" name="invoice" value="" placeholder="Unique id to reference the transaction or order" size="30"></td>

</tr>

<tr>

<td><input type="submit" value="Submit"></td>

</tr>

</table>

</form>

</body>

</html>

<?php

}

?>

Response (200):

# Directly to Payment Gateway.

# Directly to Payment Gateway.

Response (400):

# Invalid format data entered

# Invalid format data entered

Response (401):

# Invalid Merchant ID or API Key

# Invalid Merchant ID or API Key

| Parameter | Description |

|---|---|

| merchant_id |

Your merchant ID

TYPE: INTEGER

EXAMPLE: 10001

|

| invoice |

Unique invoice number

TYPE: STRING

EXAMPLE:INV0001

|

| amount |

Final amount to be paid by buyer

TYPE: STRING

EXAMPLE:250

|

| payment_desc |

Purpose of payment

TYPE: STRING

EXAMPLE:PARKING FEE

|

| currency |

Currency of payment

TYPE: STRING

EXAMPLE:MYR

|

| hash |

The secure hash string to validate the payment request sent to our Payment Gateway.

TYPE: STRING

|

Optional Arguments

| Parameter | Description |

|---|---|

| buyer_name |

Buyer's name

TYPE: STRING

EXAMPLE:JOHN

|

| buyer_email |

Buyer's email. Buyer will receive payment notification at this address if specified

TYPE: STRING

EXAMPLE:JOHN@DOMAIN.COM

|

| phone |

Buyer's phone number

TYPE: STRING

EXAMPLE:+60171234567

|

| add_line_1 |

Buyer's address line 1

TYPE: STRING

EXAMPLE:10-3, 3RD FLOOR JLN PJU 5/9

|

| add_line_2 |

Buyer's address line 2

TYPE: STRING

EXAMPLE:DATARAN SUNWAY KOTA DAMANSARA

|

| postcode |

Buyer's postcode

TYPE: INTEGER

EXAMPLE:47810

|

| city |

Buyer's city location

TYPE: STRING

EXAMPLE:PETALING JAYA

|

| comment |

Buyer's additional comments / notes on the purchase

TYPE: STRING

EXAMPLE:COMMENT HERE FOR MERCHANT REFERENCE

|

| callback_url_be |

Callback URL for your back-end process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK

|

| callback_url_fe_succ |

Callback URL for your front-end successful transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_SUCCESS

|

| callback_url_fe_fail |

Callback URL for your front-end failed transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_FAILURE

|

| baggage_variable |

If you required a variable that provide the same value after transaction has been made, use this baggage form. You can have more than one variable.

For the installment payment channel: You can set the

installment payment plan period that you want to offer to your customers.

Please include 'installmentPeriodFilter' as a value for this parameter. Otherwise, the default value offered to customers will be 12 months.

TYPE: STRING

EXAMPLE:VARIABLE1|VARIABLE2

|

| *Each of your bagages variable name* |

Your value(s) of each variable(s). Must be synchonize with the total number of variable above

For the installment payment channel: If you have included

'installmentPeriodFilter' in your baggage_variable, you may add a new parameter in your API request called

'installmentPeriodFilter'. The value must be a STRING containing the list of offered plans, separated by commas ",".

TYPE: STRING

EXAMPLE:VALUE1

|

| header_title |

Modify your company name at payment gateway checkout page

TYPE: STRING

EXAMPLE:PAYMENT HEADER TITLE

|

| header_email |

Modify your company email address at payment gateway checkout page

TYPE: STRING

EXAMPLE:SUPPORT@MERCHANT.COM

|

| header_phone |

Modify your company phone number at payment gateway checkout page

TYPE: STRING

EXAMPLE:+603283928242

|

How to receive the Payment Request response (via callback)?

The response to your payment request will be sent back to your specified back-end URL in the following format using POST method. You will receive this response after your payer complete or cancel a transaction.

Sample response:

{

"fpx_fpxTxnId": "1808241535340347",

"fpx_sellerId": "SE000008567",

"invoice_no": "INV10154632",

"txn_status": "00",

"msg": "Transaction Approved",

"txn_amount": "192.00",

"pay_method": "fpx",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d"

}

{

"fpx_fpxTxnId": "1808241535340347",

"fpx_sellerId": "SE000008567",

"invoice_no": "INV10154632",

"txn_status": "00",

"msg": "Transaction Approved",

"txn_amount": "192.00",

"pay_method": "fpx",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d"

}

| Parameter | Description |

|---|---|

|

fpx_fpxTxnId OR paypal_trx_id OR mastercard_trx_id OR others_trx_id |

Unique transaction ID. You can use this Transaction ID to track the transaction in QlicknPay's portal.

TYPE: STRING

|

| *trx_txt |

Only if 'others_trx_id' is received AND not NULL. Example: eWallet 2C2P (TNG)

TYPE: STRING

|

| fpx_sellerId |

Your FPX seller ID.

TYPE: STRING

|

| invoice_no |

Unique invoice number.

TYPE: STRING

|

| txn_status |

Response code of the status of payment.* Refer table below for description of the response code.

TYPE: STRING

|

| msg |

Status message of the payment depend on the response code from txn_status.

TYPE: STRING

|

| txn_amount |

Final amount paid by buyer.

TYPE: STRING

|

| pay_method |

Payment method chosen by buyer. Eg: fpx/paypal/mastercard/others

TYPE: STRING

|

| hash |

Secure hash string to validate the response sent to your side by our Payment Gateway.

TYPE: STRING

|

API Errors Guide

The API will return error messages if any of the variables sent is invalid.

| Error Messages | Issue |

|---|---|

| Unable to process payment due to invalid API or invalid merchant ID or no data entered. Please inform the merchant about this error. | Invalid API or Merchant ID. |

| Maximum total of amount exceeded or invalid data entered. Please assume that every transaction must be less than RM30,000 (B2C) and more than RM1.50. | Amount must be more than or equal to RM 1.50 and less than RM 30,000 (B2C). |

| Unable to process payment due to invalid Product ID entered. | Product description must be more than 0 and less than 1,000 characters. |

| Unable to process payment due to invalid API entered. Please inform the merchant about this error. | Invalid API. Your API key must be less than 14 characters. |

| Invalid data entered. | Validation errors / Hashing variables do not match the data entered. |

| Invalid URL variable specified. Please inform the merchant about this error. |

Your callback_url_be host name is not the same host name as Callback URL specified in your API Management setting.

To solve this problem, do these steps:

callback_url_be variable OR2. Specify the same host name for both callback_url_be and in your API Management setting.Example: callback_url_be:www.hostname.com/callbackv1 API Management setting: www.hostname.com/sub/sub2/callbackv2 |

| Invalid name of baggages. Please inform to the merchant about this error. |

Invalid baggages name. Baggages name cannot same as other variables(required/optional fields) name. Example: ' merchant_id'

|

| Your Invoice number is too long. Invoice number must be less than or equal to 14 characters. Please inform to the merchant about this error. | Your invoice length must more than 0 and less than 14 characters. |

| Invalid email address. Please enter a valid email address. | Invalid buyer email address specified. |

| Invalid invoices. Please inform to the merchant to check their invoice validation. |

The invoices content forbidden characters. Example: '-' |

| Invalid invoice or duplicated invoice entered. Please inform to the merchant about this error. | Invoice number must be unique for each transaction initiated. |

| Indirect error. Please inform to the merchant to specified their URL in their dasboard. | API URL, Opencart URL, Prestashop URL, Drupal URL, Ecwid URL or Woocommerce URL is not specified in the API Management setting. |

Response Code and Description

Refer to this table for the description of the returned response code.

Example response:

Please select PHP to view the sample code

<?php

#Tracing the transaction which payment method is used by your customer

if($_REQUEST['pay_method'] == 'fpx') #Using FPX

{

$trx_id = $_REQUEST['fpx_fpxTxnId']; #EX: 1808241535340347

}

else if($_REQUEST['pay_method'] == 'paypal') #Using PayPal

{

$trx_id = $_REQUEST['paypal_trx_id']; #EX: 1808241535340347

}

else if($_REQUEST['pay_method'] == 'mastercard') #Using Mastercard

{

$trx_id = $_REQUEST['mastercard_trx_id']; #EX: 1808241535340347

}

else if($_REQUEST['pay_method'] == 'others')

{

$trx_id = $_REQUEST['others_trx_id']; #EX: 1808241535340347

$_REQUEST['pay_method'] = $_REQUEST['trx_txt']; #EX: Boost eWallet and etc

}

#These are the data that posible to get from the callback URL

$fpx_sellerId = $_REQUEST['fpx_sellerId']; #EX: SE10000001

$invoice_no = $_REQUEST['invoice_no']; #EX: INV012345

$txn_status = $_REQUEST['txn_status']; #EX: 00 *You can view more txn_status value from the documentation*

$msg = $_REQUEST['msg']; #EX: Transaction Approved

$txn_amount = $_REQUEST['txn_amount']; #EX: 1289.00

$pay_method = $_REQUEST['pay_method']; #EX: fpx *Can be either fpx or PayPal

$hash = $_REQUEST['hash']; #EX: dc8e364d222d6025cbc505674b7ASDDS

$sample_bagages_variables = $_REQUEST['sample_bagages_variables']; # *The variable name is depend on what you have set when calling an API to the payment gateway. This is optional variables.

# assuming all of the data passed is correct and no validation required. Preferably you will need to validate the data passed

# This is important to prevent any attack from hackers

$hash = md5($api.$trx_id.$invoice_no.$txn_status.$msg);

if($hash == $_REQUEST['hash'])

{

echo 'OK'; # An 'OK' msg need to send to the QlicknPay as a valid respond received from the merchant.

# QlicknPay will send the callback data at most 3 times every 10 minutes if QlicknPay doesn't received an 'OK' message

#Do stuff

#You can manage your callback data here

}

else

{

echo 'Invalid Data';

#Invalid Data entered or hashing error

}

?>

| Response Code | Description |

|---|---|

| *Others* | Unable To Trace An Error |

| B0 | Order list format error |

| B1 | Invalid seller ID |

| B2 | Seller is not allow to refund |

| B3 | Seller is not allow to do multiple refund |

| B4 | Requested refund amount exceed maximum allowable |

| B5 | Original transcation ID is not found |

| B6 | Original transcation ID status is still pending debit/credit |

| B7 | Original transcation ID status was not successful |

| B8 | Previous refund request still pending debit/credit |

| B9 | Requested refund amount below minimun allowable |

| C1 | Invalid refund transcation model |

| C2 | Invalid refund buyer bank |

| C3 | Invalid refund seller bank |

| C4 | Refund request fail due to no valid order list |

| C5 | Order list contain duplicate seller order number |

| 1S | Refund Successful Submited |

| 03 | Invalid Merchant |

| 05 | Invalid Seller or Acquiring Bank Code |

| 13 | Invalid Amount |

| 00 | Transaction Approved |

| 00 | Transaction Approved |

| 03 | Invalid Merchant |

| 05 | Invalid Seller or Acquiring Bank Code |

| 13 | Invalid Amount |

| 00 | Transaction Approved |

| 09 | Transaction Pending |

| 12 | Invalid Transaction |

| 14 | Invalid Buyer Account |

| 20 | Invalid Response |

| 31 | Invalid Bank |

| 39 | No Credit Account |

| 45 | Duplicate Seller Order Number |

| 46 | Invalid Seller Exhchange or Seller |

| 47 | Invalid Currency |

| 48 | Maximum Transaction Limit Exceeded RM30,000.00 for B2C |

| 49 | Merchant Specific Limit Exceeded |

| 50 | Invalid Seller for Merchant Specific Limit |

| 51 | Insufficient Funds |

| 53 | No Buyer Account Number |

| 57 | Transaction Not Premitted |

| 58 | Transaction To Merchant Not Premitted |

| 70 | Invalid Serial Number |

| 76 | Transaction Not Found |

| 77 | Invalid Buyer Name or Buyer ID |

| 78 | Decryption Failed |

| 79 | Host Decline When Down |

| 80 | Buyer Cancel Transaction |

| 83 | Invalid Transaction Model |

| 84 | Invalid Transaction Type |

| 85 | Internel Error At Bank System |

| 87 | Debit Failed Exception Handling |

| 88 | Credit Failed Exception Handling |

| 89 | Transaction Not Received Exception Handling |

| 90 | Bank Internet Banking Unavailable |

| 92 | Invalid Buyer Bank |

| 96 | System Manulfaction |

| 98 | MAC Error |

| 99 | Pending Authorization (Applicable for B2B model) |

| BC | Transaction Cancelled By Customer |

| DA | Invalid Applcaition Type |

| DB | Invalid Email Format |

| DC | Invalid Maximum Frequency |

| DD | Invalid Frequency Mode |

| DE | Invalid Expiry Date |

| DF | Invalid e-Mandate |

| FE | Internal Error |

| OE | Transaction Rejected As Not In FPX Operating Hours |

| OF | Transaction Timeout |

| SB | Invalid Acquiring Bank Code |

| XA | Invalid Source IP Address (Applicable for B2B2 model) |

| XB | Invalid Seller Exchange IP |

| XC | Seller Exchange Encryption Error |

| XE | Invalid Message |

| XF | Invalid Number of Orders |

| XI | Invalid Seller Exchange |

| XM | Invalid FPX Transaction Model |

| XN | Transaction Rejected Due To Duplicate Seller Exchange Order Number |

| XO | Duplicate Exchange Order Number |

| XS | Seller Does Not Belong To Exchange |

| XT | Invalid Transaction Type |

| XW | Seller Exchange Date Difference Exceeded |

| 1A | Seller Buyer Session Timeout At Internet Banking Login Page |

| 1B | Buyer Failed To Provide The Necessary Info To Login To Internet Banking Login Page |

| 1C | Buyer Choose Cancel At Login Page |

| 1D | Buyer Session Timeout At Account Selection Page |

| 1E | Buyer Failed To Provide The Necessary Info To Login To Internet Banking Login Page |

| 1F | Buyer Choose Cancel At Account Selection Page |

| 1G | Buyer Session Timeout At TAC Request Page |

| 1H | Buyer Failed To Provide Necessary Info At TAC Request Page |

| 1I | Buyer Choose Cancel At TAC Request Page |

| 1J | Buyer Session Timeout At Confirmation Page |

| 1K | Buyer Failed To Provide Necessary Info At Confirmation Page |

| 1L | Buyer Choose Cancel At Confirmation Page |

| 1M | Internet Banking Session Timeout |

| 2A | Transaction Amount Is Lower Than Minimum Limit RM1.00 for B2C |

Hashing Guide

This section will explain how to secure your payment request & response using hashing method. This will be used to generate the hash field in your payment request as well as to validate the return hash from QlicknPay.

When Sending Payment Request

| Field Name | Example Value |

|---|---|

| api | APIKEY123456 |

| merchant_id | 1000034 |

| invoice | INV10154632 |

| amount | 1289.00 |

| payment_desc | Parking Fee |

| currency | MYR |

Sample code to hash above values:

md5($api."|".urldecode($merchant_id)."|".urldecode($invoice)."|".urldecode($amount)."|".urldecode($payment_desc)."|".urldecode($currency));

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

APIKEY123456|100055|INV10154632|1289.00|Parking Fee|MYR will generate something like

c0f29c5f03b96cb33df310369e3ce05d

When Receiving Payment Response

| Field Name | Example Value |

|---|---|

| fpx_fpxTxnId OR paypal_trx_id OR mastercard_trx_id OR others_trx_id |

1808241535340347 |

| *trx_txt (Only if 'others_trx_id' is received AND not NULL) |

eWallet 2C2P (TNG) |

| fpx_sellerId | SE000008567 |

| invoice_no | INV10154632 |

| msg | Transaction Approved |

| txn_status | 00 |

| txn_amount | 1289.00 |

| hash | dc8e364d222d6025cbc505674b701asdw |

| pay_method | fpx OR paypal OR mastercard OR others |

| *Your baggage variable* | *Your baggage value* |

Sample code to hash above values:

md5($api.$fpx_fpxTxnId.$invoice_no.$txn_status.$msg);

For example, if the details received are as above, the hash string to be generated is constructed as follows:

APIKEY1234561808241535340347INV01234500Transaction Approved will generate something like dc8e364d222d6025cbc505674b7012df

If the generated hash string is the same with the hash sent in the response message, the data is safe from tampering.

An 'OK' message need to display from your callback endpoint as a valid respond received. Betterpay will send the callback data at most 3 times every 10 minutes if Betterpay doesn't received an 'OK' message. (Refer sample codes given on how to display the 'OK' message from your callback endpoint)

Create Bill

You can use this API to retrieve a payment URL. This is useful if you want to contruct all the parameters of the bill from your own system, and send a final url for your payer to complete the transaction.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Requirement to use the API

Kindly get the following credentials ready in order to start using this feature.

- Merchant ID

- API Key

You can retrieve these information at the API Management page.

Required Arguments

Example request:

curl POST {Endpoint URL}\

-d merchant_id: 10010\

-d invoice: FS789\

-d amount: 150\

-d payment_desc: Parking Fee\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

-d buyer_name: John\

-d buyer_email: John@domain.com\

-d phone: +6017123123\

-d add_line_1: 10-3, 3rd Floor Jln PJU 5/9\

-d add_line_2: Dataran Sunway Kota Damansara\

-d postcode: 47810\

-d city: Petaling Jaya\

-d state: Selangor\

-d comment: Comment Here For Merchant Reference\

-d callback_url_be: https://www.example.com/callback_url_be\

-d callback_url_fe_succ: https://www.example.com/callback_fe_succ\

-d callback_url_fe_fail: https://www.example.com/callback_url_fe_fail\

-d baggage_variable: variable1|variable2\

-d variable1: value1\

-d variable2: value2\

-d header_title: Payment Title\

-d header_email: contact@gmail.com\

-d header_phone: 0123456789\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"merchant_id=10001&invoice=INV0001&amount=250&payment_desc=Parking Fee&hash=dc8e364d222d6025cbc505674b7012df&buyer_name=John&buyer_email=john@domain.com&phone=+60171234567&add_line_1=10-3, 3rd Floor Jln PJU 5/9&add_line_2=Dataran Sunway Kota Damansara&postcode=47810&city=Petaling Jaya&comment=Comment Here For Merchant Reference&callback_url_be=https://www.example.com/callback&callback_url_fe_succ=https://www.example.com/callback_success&callback_url_fe_fail=https://www.example.com/callback_success&baggage_variable=variable1|variable2&variable1=value1&variable2=value2&header_title=Payment Header Title&header_email=support@merchant.com&header_phone=+603283928242");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

Response (200):

{

"response": "00",

"merchant_id": "10010",

"invoice": "FS789",

"amount": "150",

"payment_desc": "Parking Fee",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d",

"buyer_name": "John",

"buyer_email": "John@domain.com",

"phone": "+6017123123",

"add_line_1": "10-3, 3rd Floor Jln PJU 5/9",

"add_line_2": "Dataran Sunway Kota Damansara",

"postcode": "47810",

"city": "Petaling Jaya",

"state": "Selangor",

"comment": "Comment Here For Merchant Reference",

"callback_url_be": "https://www.example.com/callback_url_be",

"callback_url_fe_succ": "https://www.example.com/callback_fe_succ",

"callback_url_fe_fail": "https://www.example.com/callback_url_fe_fail",

"baggage_variable": "variable1|variable2",

"variable1": "value1",

"variable2": "value2",

"header_title": "Payment Title",

"header_email": "contact@gmail.com",

"header_phone": "0123456789",

"url": "https://www.qlicknpay.com/receiver-disp?34-INV0001-024939-iXO"

}

{

"response": "00",

"merchant_id": "10010",

"invoice": "FS789",

"amount": "150",

"payment_desc": "Parking Fee",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d",

"buyer_name": "John",

"buyer_email": "John@domain.com",

"phone": "+6017123123",

"add_line_1": "10-3, 3rd Floor Jln PJU 5/9",

"add_line_2": "Dataran Sunway Kota Damansara",

"postcode": "47810",

"city": "Petaling Jaya",

"state": "Selangor",

"comment": "Comment Here For Merchant Reference",

"callback_url_be": "https://www.example.com/callback_url_be",

"callback_url_fe_succ": "https://www.example.com/callback_fe_succ",

"callback_url_fe_fail": "https://www.example.com/callback_url_fe_fail",

"baggage_variable": "variable1|variable2",

"variable1": "value1",

"variable2": "value2",

"header_title": "Payment Title",

"header_email": "contact@gmail.com",

"header_phone": "0123456789",

"url": "https://www.qlicknpay.com/receiver-disp?34-INV0001-024939-iXO"

}

Response (400):

{

"response": "98",

"merchant_id": "Fail to created bill."

}

{

"response": "98",

"merchant_id": "Fail to created bill."

}

Response (401):

{

"response": "99",

"merchant_id": "Invalid data entered. Please inform the merchant about this error."

}

{

"response": "99",

"merchant_id": "Invalid data entered. Please inform the merchant about this error."

}

| Field Name | Description |

|---|---|

| merchant_id |

Your merchant ID

TYPE: INTEGER

EXAMPLE: 10001

|

| invoice |

Unique invoice number

TYPE: STRING

EXAMPLE:INV0001

|

| amount |

Final amount to be paid by buyer

TYPE: STRING

EXAMPLE:250.00

|

| payment_desc |

Purpose of payment

TYPE: STRING

EXAMPLE: PARKING FEE

|

| currency |

Currency of payment

TYPE: STRING

EXAMPLE: MYR

|

| hash |

The secure hash string to validate the request. Refer our Hashing Guide

Tab for more information on how to generate the secure hash string.

TYPE: STRING

EXAMPLE: dc8e364d222d6025cbc505674b701asdw

|

Optional Arguments

| Parameter | Description |

|---|---|

| buyer_name |

Buyer's name

TYPE: STRING

EXAMPLE:JOHN

|

| buyer_email |

Buyer's email. Buyer will receive payment notification at this address if specified

TYPE: STRING

EXAMPLE:JOHN@DOMAIN.COM

|

| phone |

Buyer's phone number

TYPE: STRING

EXAMPLE:+60171234567

|

| add_line_1 |

Buyer's address line 1

TYPE: STRING

EXAMPLE:10-3, 3RD FLOOR JLN PJU 5/9

|

| add_line_2 |

Buyer's address line 2

TYPE: STRING

EXAMPLE:DATARAN SUNWAY KOTA DAMANSARA

|

| postcode |

Buyer's postcode

TYPE: INTEGER

EXAMPLE:47810

|

| city |

Buyer's city location

TYPE: STRING

EXAMPLE:PETALING JAYA

|

| comment |

Buyer's additional comments / notes on the purchase

TYPE: STRING

EXAMPLE:COMMENT HERE FOR MERCHANT REFERENCE

|

| callback_url_be |

Callback URL for your back-end process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK

|

| callback_url_fe_succ |

Callback URL for your front-end successful transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_SUCCESS

|

| callback_url_fe_fail |

Callback URL for your front-end failed transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_FAILURE

|

| baggage_variable |

If you required a variable that provide the same value after transaction has been made, use this baggage form. You can have more than one variable.

For the installment payment channel: You can set the

installment payment plan period that you want to offer to your customers.

Please include 'installmentPeriodFilter' as a value for this parameter. Otherwise, the default value offered to customers will be 12 months.

TYPE: STRING

EXAMPLE:VARIABLE1|VARIABLE2

|

| *Each of your bagages variable name* |

Your value(s) of each variable(s). Must be synchonize with the total number of variable above

For the installment payment channel: If you have included

'installmentPeriodFilter' in your baggage_variable, you may add a new parameter in your API request called

'installmentPeriodFilter'. The value must be a STRING containing the list of offered plans, separated by commas ",".

TYPE: STRING

EXAMPLE:VALUE1

|

| header_title |

Modify your company name at payment gateway pages

TYPE: STRING

EXAMPLE:PAYMENT HEADER TITLE

|

| header_email |

Modify your company email address at payment gateway pages

TYPE: STRING

EXAMPLE:SUPPORT@MERCHANT.COM

|

| header_phone |

Modify your company phone number at payment gateway pages

TYPE: STRING

EXAMPLE:+603283928242

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

| Field Name | Example Value |

|---|---|

| merchant id | 1000034 |

| API | YOURAPIKEY00192 |

| Invoice No | FS789 |

| Amount | 150.00 |

| Payment Description | Description |

| Currency | MYR |

Sample code to hash above values:

md5($API."|".urldecode($merchant_id)."|".urldecode($invoice)."|".urldecode($amount)."|".urldecode($payment_desc)."|".urldecode($currency));

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

YOURAPIKEY00192|1000034|FS789|19.90|Description|MYR will generate something like 9a360e54d7bc9de2b8850838cf4e7b11

Error Guide

The API will return error messages if any of the variables sent is invalid

| Error Code | Description |

|---|---|

| 00 | Success / No error |

| 99 | Fail to created a bill |

Remove Created Bill

You can use this API to disable the payment URL created from Create Bill API.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Requirement to use the API

Kindly get the following credentials ready in order to start using this feature.

- Merchant ID

- API Key

You can retrieve these information at the API Management page.

Required Arguments

Example request:

curl POST {Endpoint URL}\

-d merchant_id: 10010\

-d invoice: FS789\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"merchant_id=10001&invoice=INV0001&hash=dc8e364d222d6025cbc505674b7012df");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

Response (200):

{

"response": "00",

"msg": "Payment URL successfully removed",

"merchant_id": "10010",

"invoice": "FS789",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d"

}

{

"response": "00",

"msg": "Payment URL successfully removed",

"merchant_id": "10010",

"invoice": "FS789",

"hash": "fc85b97551f5a2b8bf28d916f2f8055d"

}

Response (400):

{

"response": "99",

"merchant_id": "Invoice does not exist"

}

{

"response": "99",

"merchant_id": "Invoice does not exist"

}

| Field Name | Description |

|---|---|

| merchant_id |

Your merchant ID

TYPE: INTEGER

EXAMPLE: 10001

|

| invoice |

Unique invoice number

TYPE: STRING

EXAMPLE:INV0001

|

| hash |

The secure hash string to validate the request. Refer our Hashing Guide

Tab for more information on how to generate the secure hash string.

TYPE: STRING

EXAMPLE: dc8e364d222d6025cbc505674b701asdw

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

| Field Name | Example Value |

|---|---|

| merchant id | 1000034 |

| API | YOURAPIKEY00192 |

| Invoice No | FS789 |

Sample code to hash above values:

md5($API."|".urldecode($merchant_id)."|".urldecode($invoice));

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

YOURAPIKEY00192|1000034|FS789 will generate something like a6f38ade42e7d8b9ce2a5879a626cc0c

Direct Payment

Use this feature if you would like to bypass QlicknPay checkout page, and direct payers straight from your system to the selected payment gateway (FPX) seamlessly. This is useful for developers who want to customize the full payment experience on their own website or mobile app and direct the payers to their Internet Banking login page.

Direct Payment Flow

- Request an API called ‘Get Bank List’ to get list of banks available for the payer.

- Merchant send a payment request to an API called ‘Direct Payment’.

- Payer directly to selected bank portal

- After payment is done, payer will directly to QlicknPay receipt page with a transaction status. Receipt page provide a button for them to return to merchant site (optional). Merchant can disable this receipt page and let the payer to skip and directly to selected pages by specify the variable called ‘skip_receipt’ and send it to Direct Payment API during request a payment.

- In a meantime, callback data will send to the merchant site. Please specify Callback Endpoint at your API request or you can specify it at your QlicknPay Dashboard

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Requirement to use the API

Kindly get the following credentials ready in order to start using this feature.

- Merchant ID

- API Key

You can retrieve these information from the API Management page.

Kindly ensure the payment request you send to either of the mentioned endpoints comply to the following format using POST method. You can set fields with OPTIONAL tag to NULL or exclude it entirely if it is not required.

Required Arguments

Example request:

Please select PHP to view the sample code

<?php

/**

* This is a sample code for manual integration with QlicknPay

* It is so simple that you can do it in a single file

* Make sure that in QlicnPay Dashboard you have key in the return URL referring to this file

*/

# please fill in the required info as below

$merchant_id = 'YOURMERCHANTID'; // this refers to your Merchant ID that can be obtain from PayDirect

$api = 'YOURAPIKEY'; // API key

# this part is to process data from the form that user key in, make sure that all of the info is passed so that we can process the payment

if(isset($_POST['amount']) && isset($_POST['invoice']) && isset($_POST['payment_desc']))

{

# assuming all of the data passed is correct and no validation required. Preferably you will need to validate the data passed

$hashed_string = md5($api."|".urldecode($merchant_id)."|".urldecode($_POST['invoice'])."|".urldecode($_POST['amount'])."|".urldecode($_POST['payment_desc'])."|".urldecode($_POST['bank_code'])."|".urldecode($_POST['payment_method']));

# now we send the data to PayDirect by using post method

$payment_url = '{Endpoint URL}';

?>

<html>

<head>

<title>Pay Direct Payment Gateway API Sample Code</title>

</head>

<body onload="document.order.submit()">

<!-- Specified the link below either for sandbox or live production -->

<form name="order" method="post" action="<?= $payment_url ?>">

<!-- REQUIRED FORM START HERE -->

<input type="hidden" name="merchant_id" value="<?php echo $merchant_id; ?>">

<input type="hidden" name="invoice" value="<?php echo $_POST['invoice']?>">

<input type="hidden" name="amount" value="<?php echo $_POST['amount']; ?>">

<input type="hidden" name="payment_desc" value="<?php echo $_POST['payment_desc']; ?>">

<input type="hidden" name="hash" value="<?php echo $hashed_string; ?>">

<input type="hidden" name="bank_code" value="<?php echo $_POST['bank_code']; ?>">

<input type="hidden" name="payment_method" value="<?php echo $_POST['payment_method']; ?>">

<!-- REQUIRED FORM END HERE -->

<!-- OPTIONAL FORM START HERE -->

<!-- Set this as null or remove it if you're not required this form. This form will display on payment gateway and save the value in dashboard -->

<!-- Buyer Name -->

<input type="hidden" name="buyer_name" value="John">

<!-- Buyer Email. Must be valid email address. Buyer will get transaction status through this email -->

<input type="hidden" name="buyer_email" value="John@domain.com">

<!-- Buyer Phone number with country code -->

<input type="hidden" name="phone" value="+0123456789">

<!-- Buyer Address form line 1-->

<input type="hidden" name="add_line_1" value="10-3, 3rd Floor Jln PJU 5/9">

<!-- Buyer Address form line 2-->

<input type="hidden" name="add_line_2" value="Dataran Sunway Kota Damansara">

<!-- Buyer Postcode -->

<input type="hidden" name="postcode" value="47810">

<!-- Buyer City -->

<input type="hidden" name="city" value="Petaling Jaya">

<!-- Buyer State -->

<input type="hidden" name="state" value="Selangor">

<!-- Buyer Comment -->

<input type="hidden" name="comment" value="Comment">

<!-- Your callback url for backend process. If you already have specified it on your dashboard but want a different url for different process, please include this form. -->

<!-- Your Back-end Process -->

<input type="hidden" name="callback_url_be" value="https://www.sample.com/callback_url_be.php">

<!-- Your Front-end Process Success interface -->

<input type="hidden" name="callback_url_fe_succ" value="https://www.sample.com/callback_fe_succ.php">

<!-- Your Front-end Process Fail interface -->

<input type="hidden" name="callback_url_fe_fail" value="https://www.sample.com/callback_url_fe.php">

<!-- If you required a variable that provide the same value when you return it after transaction, use this baggage form. You can have more than one variable.

Please seperate each variable and value by using '|'. Please make sure that every form's value below not more than 5000 characters -->

<!-- Your variable(s)-->

<input type="hidden" name="baggage_variable" value="variable2|variable3|variable4">

<!-- Your value(s) of each variable(s). Must be synchonize with the total variable above -->

<input type="hidden" name="variable2" value="value2">

<input type="hidden" name="variable3" value="value3">

<input type="hidden" name="variable4" value="value4">

<!-- Skip QlicknPay receipt page and directly to merchant page. Set '0' as false and '1' as true -->

<input type="hidden" name="skip_receipt" value="1">

<!-- OPTIONAL FORM END HERE -->

</form>

</body>

</html>

<?php

}

else

{

?>

<html>

<head>

<title>Pay Direct Payment Gateway API Sample Code</title>

</head>

<body>

<form method="post" action="<?php echo htmlentities($_SERVER['PHP_SELF']); ?>">

<table>

<tr>

<td colspan="2">Please fill up the detail below in order to test the payment.</td>

</tr>

<tr>

<td>Amount</td>

<td>: <input type="text" name="amount" value="" placeholder="Amount to pay, for example 12.20" size="30"></td>

</tr>

<tr>

<td>Payment Description (Not more than 1,000 character)</td>

<td>: <input type="text" name="payment_desc" value="" placeholder="Description of the transaction" size="30"></td>

</tr>

<tr>

<!-- MUST BE UNIQUE -->

<td>Invoice (Not more than 17 char without '-')</td>

<td>: <input type="text" name="invoice" value="<?= date('His') ?>" placeholder="Unique id to reference the transaction or order" size="30"></td>

</tr>

<tr>

<td>Bank</td>

<td>:

<select name='bank_code'>

<option value='ABB0233'>Affin Bank</option>

<option value='ABMB0212'>Alliance Bank (Personal)</option>

<option value='AMBB0209'>AmBank</option>

<option value='BIMB0340'>Bank Islam</option>

<option value='BKRM0602'>Bank Rakyat</option>

<option value='BMMB0341'>Bank Muamalat</option>

<option value='BSN0601'>BSN</option>

<option value='BCBB0235'>CIMB Clicks</option>

<option value='CIT0219'>Citibank</option>

<option value='HLB0224'>Hong Leong Bank</option>

<option value='HSBC0223'>HSBC Bank</option>

<option value='KFH0346'>KFH</option>

<option value='MB2U0227'>Maybank2U</option>

<option value='MBB0228'>Maybank2E</option>

<option value='OCBC0229'>OCBC Bank</option>

<option value='PBB0233'>Public Bank</option>

<option value='RHB0218'>RHB Bank</option>

<option value='SCB0216'>Standard Chartered</option>

<option value='UOB0226'>UOB Bank</option>

<option disabled>-------------------</option>

<option value='CC00001'>Credit Card</option>

<option disabled>-------------------</option>

<option value='BOOST'>Boost eWallet</option>

<option value='TNG'>TouchNGo eWallet</option>

<option value='GRAB'>Grab eWallet</option>

<option value='SHPPAY'>Shopee Pay</option>

<option value='OVO'>OVO eWallet</option>

<option value='LINKAJA'>LinkAJA eWallet</option>

</select>

</td>

</tr>

<tr>

<td>Payment Method</td>

<td>:

<select name='payment_method'>

<option value='b2c'>FPX B2C</option>

<option value='b2b'>FPX B2B</option>

<option value='cc'>Credit Card</option>

<option value='ewallet'>eWallet</option>

</select>

</td>

</tr>

<tr>

<td><input type="submit" value="Submit"></td>

</tr>

</table>

</form>

</body>

</html>

<?php

}

?>

Response (200):

# Directly to Payment Gateway.

# Directly to Payment Gateway.

Response (400):

# Invalid format data entered

# Invalid format data entered

Response (401):

# Invalid Merchant ID or API Key

# Invalid Merchant ID or API Key

| Parameter | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| merchant_id |

Your merchant ID

TYPE: INTEGER

EXAMPLE: 10001

|

||||||||||||

| invoice |

Unique invoice number

TYPE: STRING

EXAMPLE:INV0001

|

||||||||||||

| amount |

Final amount to be paid by buyer

TYPE: STRING

EXAMPLE:250

|

||||||||||||

| payment_desc |

Purpose of payment

TYPE: STRING

EXAMPLE:PARKING FEE

|

||||||||||||

| currency |

Currency of payment

TYPE: STRING

EXAMPLE:IDR

|

||||||||||||

| payment_method |

Payment Method of the payment.

TYPE: STRING

EXAMPLE:b2c

|

||||||||||||

| agent_channel_code |

Conditional. This parameter is required if you are choosing 'indo_bank' as a 'payment_method'

TYPE: STRING

EXAMPLE:ATM

|

||||||||||||

| bank_code |

For Online Banking (B2B, B2C), eWallet Payment and Indonesia Bank Portal Payment:

For Credt Card Payment:

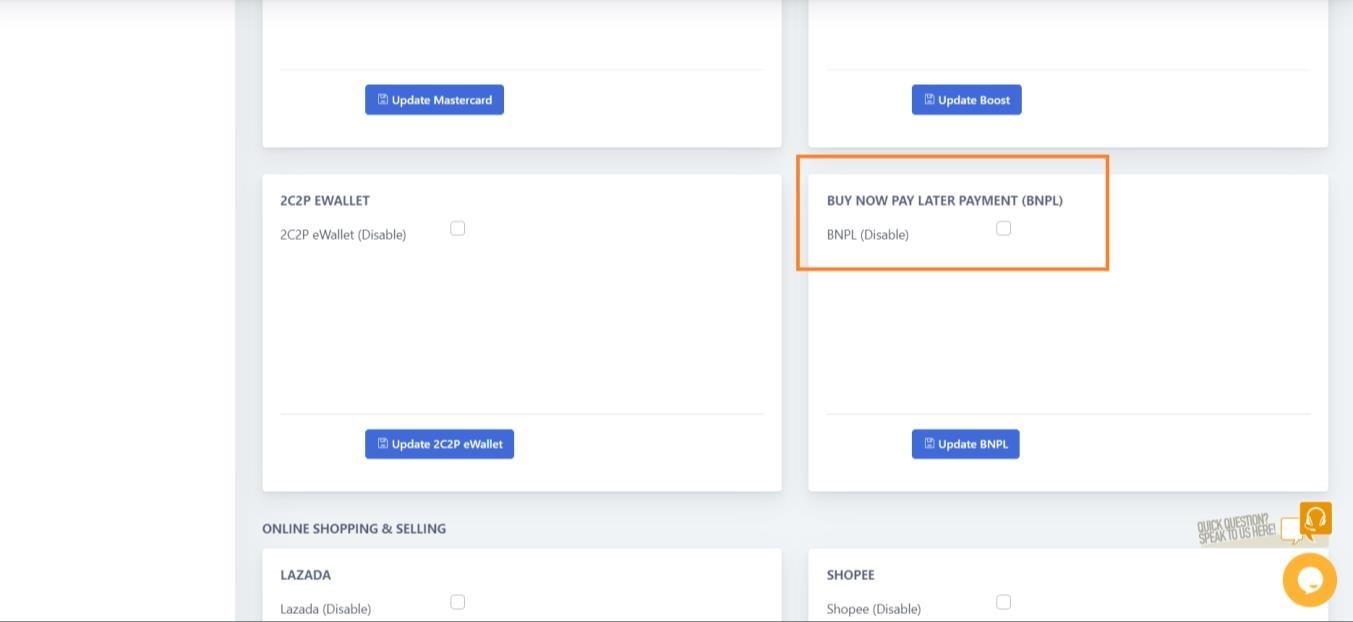

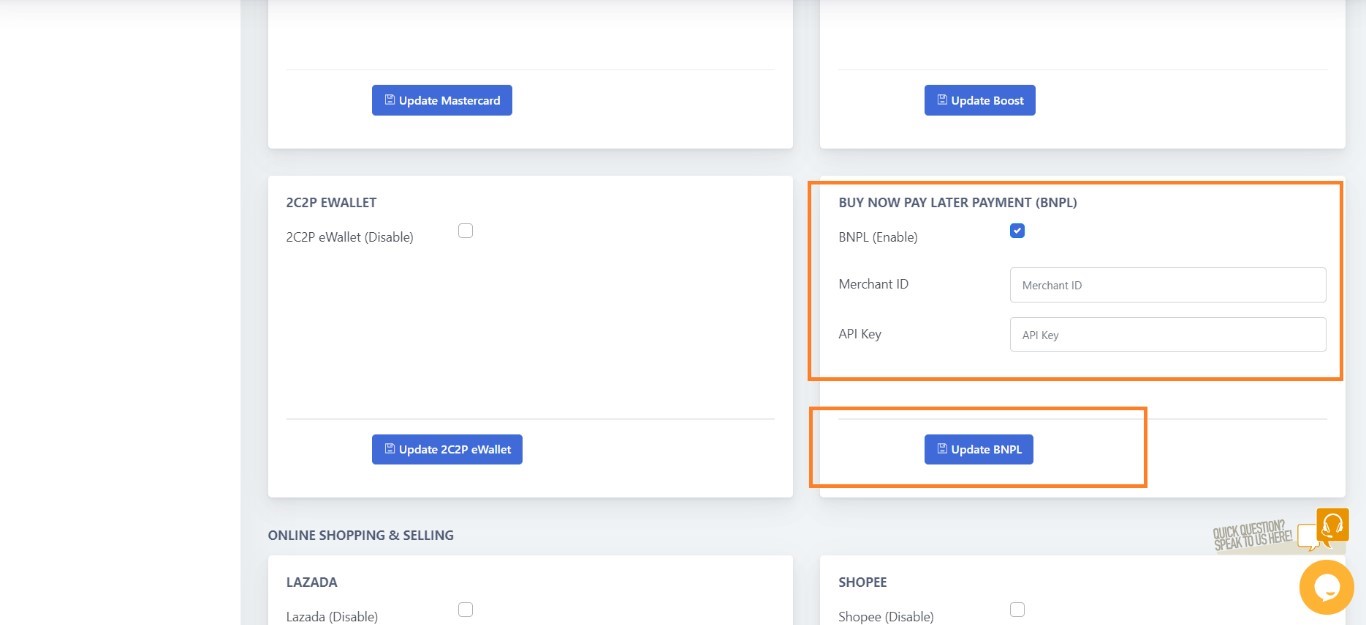

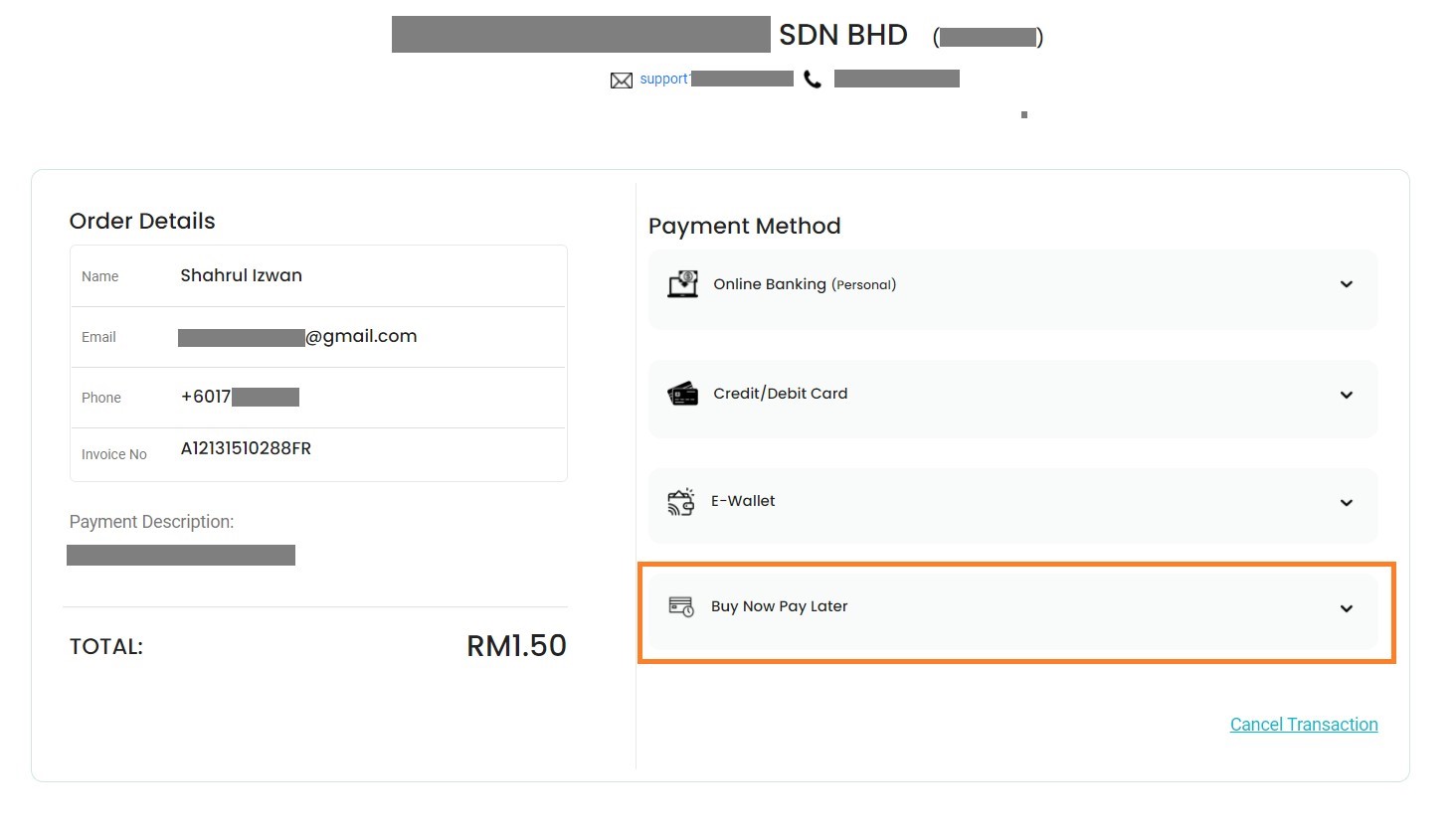

For Buy Now Pay Later Payment:

For Instalment Payment Plan (IPP):

TYPE: STRING

EXAMPLE:MB2U0227

|

||||||||||||

| hash |

The secure hash string to validate the payment request sent through our Payment Gateway.

TYPE: STRING

EXAMPLE:PARKING FEE

|

Optional Arguments

| Parameter | Description |

|---|---|

| respond |

Enable or disable response data from the API. By default, an API will directly send the payer once the API is called (By using the Form POST method). Set this value into '1' will return the response data from the API in JSON format including the URL variable called 'payment_url'. This 'payment_url' will send directly the payer to the payment portal.

TYPE: INTEGER

EXAMPLE:1

|

| buyer_name |

Buyer's name

TYPE: STRING

EXAMPLE:JOHN

|

| buyer_email |

Buyer's email. Buyer will receive payment notification at this address if specified

TYPE: STRING

EXAMPLE:JOHN@DOMAIN.COM

|

| phone |

Buyer's phone number

TYPE: STRING

EXAMPLE:+60171234567

|

| add_line_1 |

Buyer's address line 1

TYPE: STRING

EXAMPLE:10-3, 3RD FLOOR JLN PJU 5/9

|

| add_line_2 |

Buyer's address line 2

TYPE: STRING

EXAMPLE:DATARAN SUNWAY KOTA DAMANSARA

|

| postcode |

Buyer's postcode

TYPE: INTEGER

EXAMPLE:47810

|

| city |

Buyer's city location

TYPE: STRING

EXAMPLE:PETALING JAYA

|

| comment |

Buyer's additional comments / notes on the purchase

TYPE: STRING

EXAMPLE:COMMENT HERE FOR MERCHANT REFERENCE

|

| callback_url_be |

Callback URL for your back-end process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK

|

| callback_url_fe_succ |

Callback URL for your front-end successful transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_SUCCESS

|

| callback_url_fe_fail |

Callback URL for your front-end failed transaction process

TYPE: STRING

EXAMPLE:HTTPS://WWW.EXAMPLE.COM/CALLBACK_FAILURE

|

| baggage_variable |

If you required a variable that provide the same value after transaction has been made, use this baggage form. You can have more than one variable.

For the installment payment channel: You can set the

installment payment plan period that you want to offer to your customers.

Please include 'installmentPeriodFilter' as a value for this parameter. Otherwise, the default value offered to customers will be 12 months.

TYPE: STRING

EXAMPLE:VARIABLE1|VARIABLE2

|

| *Each of your bagages variable name* |

Your value(s) of each variable(s). Must be synchonize with the total number of variable above

For the installment payment channel: If you have included

'installmentPeriodFilter' in your baggage_variable, you may add a new parameter in your API request called

'installmentPeriodFilter'. The value must be a STRING containing the list of offered plans, separated by commas ",".

TYPE: STRING

EXAMPLE:VALUE1

|

| skip_receipt |

Skip QlicknPay receipt page and directly to merchant page. Set '0' as false and '1' as true

TYPE: INTEGER

EXAMPLE:1

|

Hashing Guides

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

| Field Name | Example Value |

|---|---|

| API | YOURAPIKEY00192 |

| merchant id | 1000034 |

| Invoice No | FS789 |

| Amount | 192.00 |

| Payment Description | Parking |

| Bank code | MB2U0227 |

| Payment Method | b2c |

| Currency | MYR |

Sample code to hash above values:

md5($API."|".urldecode($merchant_id)."|".urldecode($invoice)."|".urldecode($amount)."|".urldecode($payment_desc)."|".urldecode(bank_code)."|".urldecode(payment_method)."|".urldecode(currency));

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

YOURAPIKEY00192|1000034|FS789|19.90|Parking|MB2U0227|b2c|MYR will generate something like f175d40f33c9ab1eb26118951a147e4a

Collection Payment Link API

This API allow you to create a single Payment Link and do a multiple collection.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Required Arguments

Example request:

curl POST {Endpoint URL}\

-d merchant_id: R1001\

-d purpose: Annual Payment\

-d amount: 1.50\

-d delivery_option: 0\

-d amount_option: Fixed\

-d due_date: 2025-08-31\

-d usage: 1\

-d max_collection: 100.00\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"merchant_id=R1001&purpose=Annual Payment&amount=1.50

&delivery_option=0&amount_option=Fixed&due_date=2025-08-31 &usage=1&max_collection=100.00&hash=fc85b97551f5a2b8bf28d916f2f8055d");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

| Field Name | Description |

|---|---|

| merchant_id | Your merchant ID

TYPE: STRING

EXAMPLE: R1001

|

| purpose | Description of the payment link. Must be a unique

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| amount_option | Type of amount for payment link. Only accept a fixed or flexi amount

TYPE: STRING

EXAMPLE: Fixed

|

| amount | Fixed amount for the payment link. This is a conditional parameter and only required if the value of

parameter 'amount_option' is "Fixed"

TYPE: STRING

EXAMPLE: 100.55

|

| delivery_option | Allow checkout page to display the delivery form as mandatory fields.

TYPE: INTERGER

EXAMPLE: 0

|

| currency |

Currency of payment

TYPE: STRING

EXAMPLE:MYR

|

| hash | The secure hash string to validate the request. Refer below hashing guide for more

information on how to generate the secure hash string.

TYPE: STRING

EXAMPLE: dc8e364d222d6025cbc505674b701asdw

|

Optional Arguments

| Field Name | Description |

|---|---|

| due_date | Expiry date of the Payment Link.

TYPE: DATE

EXAMPLE: 2025-08-31

|

| usage | Total maximum successful payment are allowed. For example, if this parameter set as '50', means the

successful payment accept must be not more than 50 payments.

TYPE: INTERGER

EXAMPLE: 44

|

| max_collection | Total maximum amount collection are allowed. For example, if this parameter set as '1000.50', means the

total collection for the payment link must be less than RM1,000.50.

TYPE: STRING

EXAMPLE: 1500.55

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

| Field Name | Example Value |

|---|---|

| API | YOURAPIKEY00192 |

| merchant_id | R1001 |

| purpose | Annual Payment |

| delivery_option | 0 |

| amount_option | Fixed |

| amount | 10.00 |

| currency | MYR |

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

Sample code to hash above values:

md5("$api|$merchant_id|$purpose|$amount_option|$amount|$delivery_option|$currency");

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

"YOURAPIKEY00192|R1001|Annual Payment|Fixed|10.00|0|MYR" will generate something like

40a78c01b5e2e9565b0d02196ec28047

For "Unfixed" payment link, below is a sample details:

"YOURAPIKEY00192|R1001|Annual Payment|Unfixed||0|MYR" will generate something like

f262522ea66154fd83d2068ee3820235

Respond data

The response data after calling the API

Example response:

{

"response":"00",

"payment_link_url":"http://127.0.0.1:8000/payment-link/s/R1233-INV0004",

"purpose":"Donation for kids",

"amount_option": "Fixed",

"amount":100,

"delivery_option":1,

"merchant_id":"R1233"

"due_date":"2023-08-02",

"usage":8,

"max_collection":"6779"

"hash":"fc85b97551f5a2b8bf28d916f2f8055d"

}

{

"response":"00",

"payment_link_url":"http://127.0.0.1:8000/payment-link/s/R1233-INV0004",

"purpose":"Donation for kids",

"amount_option": "Fixed",

"amount":100,

"delivery_option":1,

"merchant_id":"R1233"

"due_date":"2023-08-02",

"usage":8,

"max_collection":"6779"

"hash":"fc85b97551f5a2b8bf28d916f2f8055d"

}

| Parameter | Description |

|---|---|

| response

|

Response code of the status of created Payment Link.

00 - Successfull 99 - Unsucessfull TYPE: INTERGER

|

| payment_link_url

|

Response Unique Url of the created Payment Link.

TYPE: INTERGER

|

| purpose

|

Description of the payment link. Must be a unique

TYPE: INTERGER

|

| amount_option

|

Type of amount for payment link. Only accept a fixed or flexi amount.

TYPE: STRING

|

| merchant_id

|

Your merchant ID

TYPE: STRING

|

| due_date

|

Expiry date of the Payment Link.

TYPE: DATE

|

| usage

|

Total maximum successful payment are allowed. For example, if this parameter set as '50', means the

successful payment accept must be not more than 50 payments.

TYPE: INTERGER

|

| max_collection | Total maximum amount collection are allowed. For example, if this parameter set as '1000.50', means the

total collection for the payment link must be less than RM1,000.50.

TYPE: STRING

|

Delete Collection Payment Link API

This API allows you to Delete collection of Payment Links.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Example request:

curl POST {Endpoint URL}\

-d id: 7\

-d merchant_id: R1001\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"id=7&merchant_id=R1001&hash=fc85b97551f5a2b8bf28d916f2f8055d");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

| Field Name | Description |

|---|---|

| Id |

Your Payment link ID. You can get your Payment Link ID by calling List

Collection Payment Link API

TYPE: STRING

EXAMPLE: 1

|

| merchant_id |

Your merchant ID

TYPE: STRING

EXAMPLE: R1001

|

| hash |

The secure hash string to validate the request. Refer below hashing guide for more

information on how to generate the secure hash string.

TYPE: STRING

EXAMPLE: dc8e364d222d6025cbc505674b701asdw

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

Sample code to hash above values:

md5("$api|$merchant_id|$id");

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

"YOURAPIKEY00192|R1001|13" will generate something like a68115315fbc9759076dcf7a058ce221

Respond data

The response data after calling the API

Example response:

{

"id": "13",

"merchant_id": "R1001",

"response": "00",

"msg": "Success Deleted",

}

{

"id": "13",

"merchant_id": "R1001",

"response": "00",

"msg": "Success Deleted",

}

| Parameter | Description |

|---|---|

|

Id |

Your Payment Link ID.

TYPE: STRING

|

| merchant_id |

Your Merchant ID.

TYPE: STRING

|

| response | Response code of the status of deleted Payment Link. |

| msg |

Status message of the payemnet link depend on the response code from response.

TYPE: STRING

|

List Collection Payment Link API

This API allows you to access a list collection of Payment Links.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Example request:

curl POST {Endpoint URL}\

-d merchant_id: R1001\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"merchant_id=R1001&hash=fc85b97551f5a2b8bf28d916f2f8055d");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

| Field Name | Description |

|---|---|

| merchant_id | Your merchant ID

TYPE: STRING

EXAMPLE: R1001

|

| hash | The secure hash string to validate the request. Refer below hashing guide for more

information on how to generate the secure hash string.

TYPE: STRING

EXAMPLE: dc8e364d222d6025cbc505674b701asdw

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

Sample code to hash above values:

md5("$api|$merchant_id");

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

"YOURAPIKEY00192|R1001" will generate something like e4a9dd90a49380fa4a34105fb8bacba5

Respond data

The response data after calling the API

Example response:

{

"respon":"00",

"merchant_id":"R1233",

"data": [

{

"id":17,

"inv_number":"INV0004",

"amount_option":"Fixed",

"amount":3131,

"delivery_option":0,

"status":"Active",

"payment_url":"http://127.0.0.1:8000/payment-link/s/R1233-INV0004",

"logo_url":null,

"qr_url": URL,

"created_at":"2023-07-28T02:28:17.000000Z",

"updated_at":"2023-07-28T02:28:17.000000Z",

"deleted_at":null

},

]

}

{

"respon":"00",

"merchant_id":"R1233",

"data": [

{

"id":17,

"inv_number":"INV0004",

"amount_option":"Fixed",

"amount":3131,

"delivery_option":0,

"status":"Active",

"payment_url":"http://127.0.0.1:8000/payment-link/s/R1233-INV0004",

"logo_url":null,

"qr_url": URL,

"created_at":"2023-07-28T02:28:17.000000Z",

"updated_at":"2023-07-28T02:28:17.000000Z",

"deleted_at":null

},

]

}

| Parameter | Description |

|---|---|

| merchant_id |

Your Merchant ID.

TYPE: STRING

|

|

Id |

Your Payment Link ID.

TYPE: STRING

|

| inv_number |

Unique invoice number.

TYPE: STRING

|

| purpose | Description of the payment link.

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| amount_option | Type of amount option for payment link.

TYPE: STRING

EXAMPLE: Fixed

|

| amount | Fixed amount for the payment link. This is a conditional parameter and only required if the value of

parameter 'amount_option' is "Fixed"

TYPE: STRING

EXAMPLE: 100.55

|

| delivery_option | Allow checkout page to display the delivery form as mandatory fields.

TYPE: INTERGER

EXAMPLE: 0

|

| logo_url | The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| qr_url |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| usage

|

Total maximum successful payment are allowed. For example, if this parameter set as '50', means the

successful payment accept must be not more than 50 payments.

TYPE: INTERGER

|

| max_collection | Total maximum amount collection are allowed. For example, if this parameter set as '1000.50', means the

total collection for the payment link must be less than RM1,000.50.

TYPE: STRING

|

| due_date

|

Expiry date of the Payment Link.

TYPE: DATE

|

Report Collection Payment Link API

This API allows you to access a list collection of Payment Links.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Example request:

curl POST {Endpoint URL}\

-d merchant_id: R1001\

-d hash: fc85b97551f5a2b8bf28d916f2f8055d\

-d date_from: 2023-06-01\

-d date_to: 2023-07-27\

-d purpose: donation for kids\

$ch = curl_init();

curl_setopt($ch, CURLOPT_URL,"POST {Endpoint URL}");

curl_setopt($ch, CURLOPT_POST, 1);

curl_setopt($ch, CURLOPT_POSTFIELDS,

"merchant_id=R1001&hash=fc85b97551f5a2b8bf28d916f2f8055d

&date=2023-06-01&date_to=2023-07-27

&purpose=donation for kids");

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

$server_output = curl_exec($ch);

curl_close ($ch)

| Field Name | Description |

|---|---|

| merchant_id | Your merchant ID

TYPE: STRING

EXAMPLE: R1001

|

| date_from | By default the date will be the date of first transaction data.

TYPE: DATE

EXAMPLE: 2025-08-31

|

| date_to | By default the date will be the date of last batch data.

TYPE: DATE

EXAMPLE: 2025-08-31

|

| status | By default the status will display all the status of the transactions.

0 - All successful payments 1 - All fail payments TYPE: STRING

EXAMPLE: 1

|

| purpose |

Description of the payment link.

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

Hashing Guide

This section will explain how to secure request. This will be used to generate the hash field in your request from merchant's site.

Sample code to hash above values:

md5("$api|$merchant_id|$purpose|$date_to|$date_from");

For example, if the details to be sent are as above, the hash string to be generated is constructed as follows:

"YOURAPIKEY00192|R1001|donation for kids|2023-07-27|2023-06-01" will generate something like

b280fb8b6d0a7d81a5be475a64107db6

Respond data

The response data after calling the API

Example response:

{

"response": "00",

"merchant_id": "R1233",

"date_from": "2023-07-01",

"date_to": "2023-08-01",

"purpose": null,

"hash": "fc85b97551f5a2b8bf28d916f2f8055d",

"data": [

{

"transaction_id": null,

"total_amount": null,

"invoice": null,

"buyer_name": null,

"buyer_email": null,

"phone": null,

"address": null,

"city": null,

"state": null,

"postcode": null,

"comment": null,

"status": null,

"pay_method": null,

"callback_be": null,

"currency": null,

"created_at": "2023-07-10T08:01:03.000000Z"

}

],

}

{

"response": "00",

"merchant_id": "R1233",

"date_from": "2023-07-01",

"date_to": "2023-08-01",

"purpose": null,

"data": [

{

"transaction_id": null,

"total_amount": null,

"invoice": null,

"buyer_name": null,

"buyer_email": null,

"phone": null,

"address": null,

"city": null,

"state": null,

"postcode": null,

"comment": null,

"status": null,

"pay_method": null,

"callback_be": null,

"currency": null,

"created_at": "2023-07-10T08:01:03.000000Z"

}

],

}

| Parameter | Description |

|---|---|

| response | Response code of the status of list collection Payment Link.

00 - Successfull 99 - Unsuccessfull TYPE: STRING

|

| merchant_id |

Your Merchant ID.

TYPE: STRING

|

|

Id |

Your Payment Link ID.

TYPE: STRING

|

| date_from | By default the date will be the date of first batch data.

TYPE: DATE

EXAMPLE: 2025-08-31

|

| date_to | By default the date will be the date of last batch data.

TYPE: DATE

EXAMPLE: 2025-08-31

|

| purpose |

Description of the payment link.

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| transaction_id | Unique transaction ID generate by Betterpay.

TYPE: INTERGER

|

| amount_option |

Type of amount option for payment link.

TYPE: STRING

EXAMPLE: Fixed

|

| amount |

Fixed amount for the payment link. This is a conditional parameter and only required if the value of

parameter 'amount_option' is "Fixed"

TYPE: STRING

EXAMPLE: 100.55

|

| delivery_option |

Allow checkout page to display the delivery form as mandatory fields.

TYPE: INTERGER

EXAMPLE: 0

|

| buyer_name |

Description of the payment link.

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| phone |

Buyer's phone number

TYPE: STRING

EXAMPLE: 017-86331311

|

| address |

Buyer's address

TYPE: STRING

EXAMPLE: LOT 12, Taman Jaya

|

| city |

Buyer's city

TYPE: STRING

EXAMPLE: kOTA BHARU

|

| state |

Buyer's state

TYPE: STRING

EXAMPLE: KELANTAN

|

| postcode |

Buyer's postcode

TYPE: INTERGER

EXAMPLE: 160000

|

| comment |

Buyer's additional comments / notes on the purchase

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| status | By default the status will display all the status of the transactions.

TYPE: STRING

EXAMPLE: OMMENT HERE FOR MERCHANT REFERENCE

|

| callback_be |

Description of callback

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| currency |

Currency of payment

TYPE: STRING

EXAMPLE: MYR

|

| created_at | Date of the transaction being make

TYPE: STRING

EXAMPLE: Online Payment for Parking Ticket

|

| logo_url |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| qr_url |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| created_at |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| updated_at |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

| deleted_at |

The URL for payment is generated by the system.

TYPE: STRING

EXAMPLE: http://127.0.0.1:8000/payment-link/s/R1233-INV0004

|

Create Invoice API

This API allow you to create an invoice and include it with a payment link.

API Endpoint URLs

- Production:

POST Please login to view the endpoint - Sandbox:

POST Please login to view the endpoint

Required Arguments

Example request:

curl -X POST {Endpoint URL}\

-H "Content-Type: application/json" \

-d '{

"merchant_id": "R10001",

"invoice_id": "INV0123",

"currencies": [

"MYR"

],

"items": {

"1": {

"description": "Product #1",

"quantity": "3",

"amount": "30.20"

},

"2": {

"description": "Product #2",

"quantity": "1",

"amount": "100.20"

},

"3": {

"description": "Product #3",

"quantity": "10",

"amount": "310.20"

}

},

"email": "customer@domain.com",

"phone": "+60179999999",

"partial_payment_status": 1,

"description": "General description of this invoice is here",

"note": "Sample note for invoicing #1",

"send_at": "2025-09-01 16:15:00",

"expired_at": "2025-09-30 16:15:00",

"attachments": [

"https://www.domain.com/attachment/document_1.pdf",

"https://www.domain.com/attachment/img.gif",

],

"tax": [

{

"type": "percentage",

"amount": "10"

},

{

"type": "fixed",

"amount": "2.50"

}

],

"reminders": {

"due_in": {

"1": {

"message": "Your invoice is due in 3 days!"

},

"3": {

"message": "Hi there please make a payment ASAP!"

}

},

"overdue": {

"1": {

"message": "Your invoice is already overdue by 4 days!"

},

"4": {

"message": "No payment are received! Please contact me."

}

}

},

"hash": "{{Generated hash value}}"

}'

$data = [

"merchant_id" => "R10001",

"invoice_id" => "INV0123",

"currencies" => ["MYR"],

"items" => [

"1" => [

"description" => "Product #1",

"quantity" => "3",

"amount" => "30.20"

],

"2" => [

"description" => "Product #2",

"quantity" => "1",

"amount" => "100.20"

],

"3" => [

"description" => "Product #3",

"quantity" => "10",

"amount" => "310.20"

]

],

"email" => "customer@domain.com",

"phone" => "+60179999999",

"partial_payment_status" => 1,

"description" => "General description of this invoice is here",

"note" => "Sample note for invoicing #1",

"send_at" => "2024-07-04 16:15:00",

"expired_at" => "2024-08-02 16:15:00",

"attachments" => [

"https://www.domain.com/attachment/document_1.pdf",

"https://www.domain.com/attachment/img.gif"

],

"tax" => [

[

"type" => "percentage",

"amount" => "10"

],

[

"type" => "fixed",

"amount" => "2.50"

]

],

"reminders" => [

"due_in" => [

"1" => [

"message" => "Your invoice is due in 3 days!"

],

"3" => [

"message" => "Hi there please make a payment ASAP!"

]

],

"overdue" => [

"1" => [

"message" => "Your invoice is already overdue by 4 days!"

],

"4" => [

"message" => "No payment are received! Please contact me."

]

]

],

"hash" => "{{Generated hash value}}"

];

$endpointUrl = "{Endpoint URL}";

$payload = json_encode($data);

$ch = curl_init($endpointUrl);

curl_setopt($ch, CURLOPT_RETURNTRANSFER, true);

curl_setopt($ch, CURLOPT_POST, true);

curl_setopt($ch, CURLOPT_HTTPHEADER, [

'Content-Type: application/json',

'Content-Length: ' . strlen($payload)

]);

curl_setopt($ch, CURLOPT_POSTFIELDS, $payload);

$response = curl_exec($ch);

curl_close($ch);

echo $response;

| Field Name | Description |

|---|---|

| merchant_id | Your merchant ID

TYPE: STRING

EXAMPLE: R10001

|

| invoice_id | Unique Invoice ID defined by your system

TYPE: STRING

EXAMPLE: INV0123

|